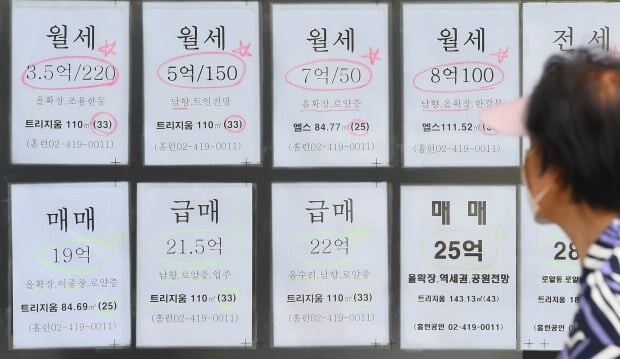

Seoul, South Korea – The proportion of monthly rent contracts in Seoul and Gyeonggi-do's villa rental market has surpassed 50% for the first time this year, a significant shift driven by concerns over "jeonse fraud" incidents.

Jeonse is a unique South Korean rental system where tenants pay a large lump-sum deposit at the start of the lease, which is returned at the end, often without interest. However, a series of fraud cases involving landlords failing to return jeonse deposits has eroded trust in this system.

According to data from the Ministry of Land, Infrastructure and Transport, monthly rent contracts accounted for 53.6% of all villa rental contracts in Seoul this year, marking a significant increase from 29.5% in 2020. This trend is even more pronounced when compared to apartment rentals, where monthly contracts account for 41.6%.

Key factors driving the shift:

Jeonse fraud: A series of high-profile jeonse fraud cases has made tenants wary of the system, leading them to opt for monthly rent contracts instead.

Interest rate hikes: Rising interest rates have made it more expensive for landlords to finance jeonse deposits, pushing them to seek monthly rent contracts.

Affordability: Monthly rent contracts are often more affordable for tenants, especially those with limited upfront capital.

Impact on the rental market:

Rising monthly rents: As demand for monthly rent contracts increases, so too have rental rates. In both Seoul and Gyeonggi-do, average monthly rents for villas have reached their highest levels in recent years.

Foreign investment: The shift towards monthly rent contracts has attracted foreign investors, particularly private equity firms, who see opportunities in the growing South Korean rental market.

Tenant burden: While monthly rent contracts offer more flexibility, they can also lead to higher overall housing costs for tenants, as they pay rent continuously rather than a large lump sum upfront.

Expert commentary:

"The jeonse fraud scandal has fundamentally changed the villa rental market," said [Name], a real estate expert. "Monthly rent is now the new normal for many tenants, as they prioritize security over upfront costs. However, this shift also means that tenants are facing increased housing costs."

[Copyright (c) Global Economic Times. All Rights Reserved.]