The world's largest sovereign wealth fund, the Government Pension Fund Global (GPFG) of Norway, reported a robust return of 5.8% for the third quarter, largely attributable to a powerful upswing in global stock markets. The fund, managed by Norges Bank Investment Management (NBIM), announced the results on October 29 (local time).

Fund Value Soars to $2.9 Trillion

As of the end of September, the fund's total assets reached 20.44 trillion Norwegian kroner (approximately $2.9 trillion), marking an increase of 854 billion kroner over the three-month period. The fund, established in the 1990s to invest surplus revenues from Norway's oil and gas industry on behalf of the Norwegian people, currently holds assets in 70 countries. The accounting return for the quarter was reported at 1.03 trillion kroner, equating to $102.56 billion in profit.

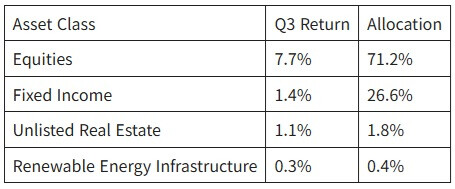

Equity Investments Lead the Way

The fund's strong performance was spearheaded by its equity portfolio, which delivered a 7.7% return during the quarter. Trond Grande, Deputy CEO of NBIM, stated, "The result is driven by strong returns in the stock market, particularly in basic materials, telecommunications, and the financial sector."

U.S. equities constitute a substantial portion—roughly 40%—of NBIM's stock holdings. Major investments include tech giants such as Alphabet, Amazon, Nvidia, and Microsoft, alongside financial and retail stalwarts like JPMorgan, Walmart, Eli Lilly, and Coca-Cola.

Despite the overall strong performance, the fund's return fell slightly short of its benchmark index by 0.06 percentage points.

Krone Appreciation and Political Fallout

During the third quarter, the Norwegian krone appreciated by 0.7% against the U.S. dollar, extending its year-long gain to 12%.

The report comes on the heels of a political spat last month. NBIM faced the wrath of the U.S. government—specifically the Trump administration—after deciding to restrict its investments in certain Israeli-related companies. The U.S. State Department expressed concern over the fund's sale of its stake in Caterpillar, linking the divestment to the conflict in the Gaza Strip.

[Copyright (c) Global Economic Times. All Rights Reserved.]