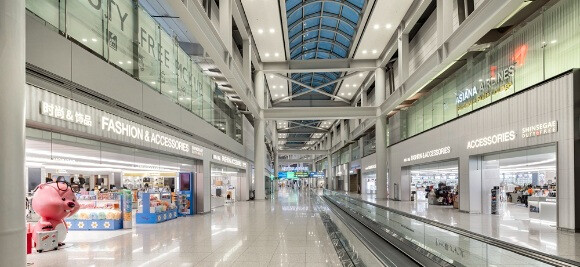

SEOUL — A fierce, yet cautious, battle is brewing among duty-free operators over the upcoming re-tender for prime retail spaces at Incheon International Airport (IIAC), the gateway to South Korea. Following the highly publicized surrender of key concessions (DF1 and DF2) by major domestic players The Shilla Duty Free and Shinsegae Duty Free due to unsustainably high rents, the IIAC is set to launch the re-bidding process soon, with an announcement expected before the year's end.

The decision by Shilla and Shinsegae to return their rights stems from a significant mismatch between the aggressive rental bids placed during the 2023 tender and the post-pandemic reality of the duty-free market. Despite recovering passenger volumes, high foreign exchange rates and a shift in consumer spending—including diminished 'daigou' (purchasing agent) activity—have severely reduced the average spend per passenger (객단가, gaekdanga). This made the per-passenger rental formula, upon which the original bids were based, a critical financial burden.

The central point of contention in the current atmosphere of palpable tension is the minimum acceptance fee (최저수용금액) the IIAC will set. During the 2023 auction, the minimum acceptance fees for DF1 and DF2 were set at 5,346 KRW and 5,616 KRW per passenger, respectively. However, Shilla and Shinsegae, driven by intense competition and overly optimistic recovery forecasts, submitted winning bids significantly higher—8,987 KRW and 9,020 KRW. The subsequent financial strain led to their forced withdrawal, despite a court-ordered appraisal suggesting re-bid prices should be approximately 40% lower than current rates.

Industry sentiment now overwhelmingly favors a "prudent bidding" strategy. Domestic heavyweights, including Lotte Duty Free (which previously exited the airport in 2023 after a cautious bid that proved prescient), Hyundai Department Store Duty Free, and even the withdrawing operators Shilla and Shinsegae, are expected to participate. However, the high-cost lesson from the previous round will serve as a stark warning, making an excessive bid—the so-called 'winner's curse'—unlikely. Operators will likely approach the concessions based on a careful calculation of an "acceptable deficit" for the symbolic value of an Incheon presence rather than a straightforward profit expectation.

The domestic industry's cautious stance has, in turn, opened a window for international operators. Key global players are reportedly monitoring the situation, including China Duty Free Group (CDFG), Thailand’s King Power, France’s Lagardere, and Switzerland's Avolta (formerly Dufry). If local contenders submit conservative bids, the entry of a powerful foreign competitor could significantly reshape the landscape of South Korea's duty-free sector. CDFG, the world's second-largest travel retailer, is seen as a particularly formidable contender, having participated in the 2023 bidding.

While the bidding will be open, the IIAC's evaluation criteria are expected to place greater emphasis on qualitative assessments, such as 'business stability.' This could disadvantage the two operators who have a recent history of contract termination, despite their potential participation. The success of this crucial rebid—and the long-term financial health of the airport's duty-free operation—is largely dependent on the IIAC's ability to present a minimum fee that realistically reflects the current, challenging market conditions.

[Copyright (c) Global Economic Times. All Rights Reserved.]