WASHINGTON D.C. – The United States Commerce Department reportedly considered expanding its restrictions on semiconductor equipment exports to China last week, a move that would have significantly escalated the ongoing economic tensions between the two global powers. This deliberation occurred just prior to the second round of high-level trade negotiations between Washington and Beijing in London. While the immediate threat of broader curbs appears to have receded, the consideration itself underscores the potent role of semiconductor technology as a strategic leverage point in the complex U.S.-China relationship.

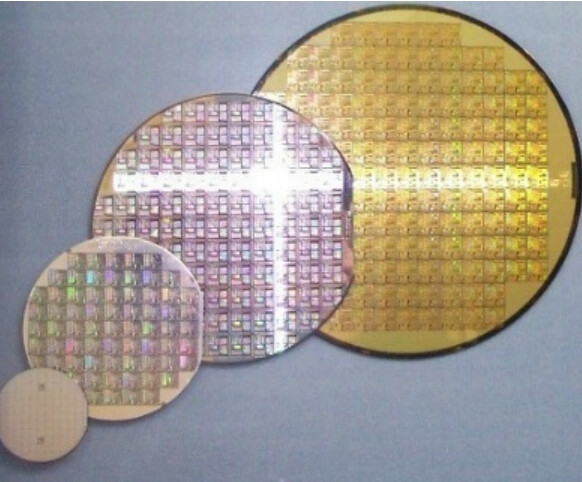

According to sources cited by The Wall Street Journal on June 16, U.S. Commerce Department officials explored the possibility of widening export limitations on semiconductor manufacturing equipment. This contingency planning was reportedly in place should the trade talks fail to yield a satisfactory outcome. Had these broader restrictions been enacted, they would have extended beyond advanced chips, impacting equipment used in the production of semiconductors essential for everyday devices such as smartphones and automobiles, potentially causing significant disruption across global supply chains.

The high-stakes trade negotiations, held in London on June 9-10, 2025, aimed to de-escalate tensions and establish a framework for implementing agreements reached during a prior meeting in Geneva in May 2025. U.S. Commerce Secretary Howard Lutnick and Chinese Vice Commerce Minister Li Chenggang led their respective delegations through intense discussions. While specific details of the London agreement remain undisclosed, U.S. President Donald Trump indicated that the deal included provisions for China's supply of rare earth elements to the U.S. and continued allowances for Chinese students in American universities. This framework agreement is now pending final approval from both President Trump and Chinese President Xi Jinping.

Escalating Trade Tensions and Strategic Controls

The contemplation of expanded semiconductor curbs highlights the persistent and multi-faceted nature of the U.S.-China trade dispute. Over the past few years, the U.S. has incrementally tightened its grip on China's access to advanced semiconductor technology, citing national security concerns and a desire to maintain American technological leadership. The October 2022 controls, which restricted China's access to advanced computing chips and manufacturing equipment, were further tightened in October 2023 and December 2024. In March 2025, the Trump administration imposed additional chip export restrictions, blacklisting dozens of Chinese entities involved in advanced strategic technologies. Most recently, on June 19, 2025, the U.S. government canceled export licenses for companies selling advanced chips to Huawei and SMIC, a decision spurred by Huawei's use of a 7-nanometer chip, which raised concerns about the effectiveness of existing export controls.

These measures have had a tangible impact. The Wall Street Journal analysis suggested that an expansion of restrictions could result in billions of dollars in lost revenue for major U.S. semiconductor equipment manufacturers such as Applied Materials, Lam Research, and KLA. These companies, crucial players in the global semiconductor ecosystem, reportedly derive approximately 40% of their revenue from the Chinese market, making them particularly vulnerable to escalating trade tensions.

Rare Earths and Economic Warfare

The recent trade talks also underscored the critical role of rare earth elements in the strategic competition between the two nations. Rare earths, a group of 17 minerals vital for various high-tech products ranging from electric vehicles to advanced defense systems, are predominantly controlled by China in terms of mining and processing. The original article mentioned that China had reportedly set a six-month limit on rare earth sales to U.S. automotive manufacturers, a move interpreted as an attempt to bolster its negotiating position should trade hostilities intensify. The U.S., on the other hand, seeks guaranteed access to these critical minerals to counter China's leverage.

Dmitri Alperovitch, co-founder of the Silverado Policy Institute, characterized semiconductor export controls as the "most powerful weapon" in the economic struggle with China, suggesting that now is an opportune time to deploy such leverage. This sentiment reflects a broader perspective within Washington that views technological dominance, particularly in semiconductors, as central to national security.

Internal Divisions and Global Implications

Despite a seemingly unified front against China's technological ambitions, the U.S. government remains divided on the extent and severity of export restrictions. Officials prioritizing national security advocate for more stringent measures, arguing they are essential to prevent China from developing advanced military capabilities. Conversely, business-friendly voices emphasize the importance of promoting and supporting U.S. corporate exports, expressing concerns that overly restrictive policies could harm American companies, stifle innovation, and inadvertently accelerate China's drive for self-sufficiency in chip production.

The ongoing "Chips War" highlights the intricate interdependencies within the global semiconductor supply chain. No single nation possesses full control over the complex chip-making process; Americans largely design, Asians manufacture, and Europeans build the machines enabling production. While U.S. export controls have indeed limited China's access to cutting-edge American technology, they have also incentivized China to redouble its efforts in domestic chip innovation and production. Reports indicate that Chinese firms are resorting to ingenious methods, including processing data abroad and even smuggling, to circumvent U.S. chip bans. This complex dynamic illustrates the challenges of enforcing export controls and the potential for unintended consequences, as Chinese companies are compelled to become more independent.

The London talks, while yielding a framework agreement, are unlikely to be the final chapter in the U.S.-China trade saga. Analysts widely anticipate continued negotiations throughout 2025, with a palpable shift in focus from traditional tariffs to the more nuanced and strategically vital domain of export controls. The global economic landscape remains cautious, with market indices experiencing fluctuations and technology stocks particularly affected by the uncertainties surrounding trade relations and supply chain vulnerabilities. As both nations continue to navigate this delicate balance of cooperation and competition, the semiconductor industry will undoubtedly remain at the heart of their evolving geopolitical struggle.

[Copyright (c) Global Economic Times. All Rights Reserved.]