Seoul, South Korea – South Korea's largest conglomerates experienced a substantial decline in their combined market capitalization last year, primarily attributed to a broad downturn in the stock market.

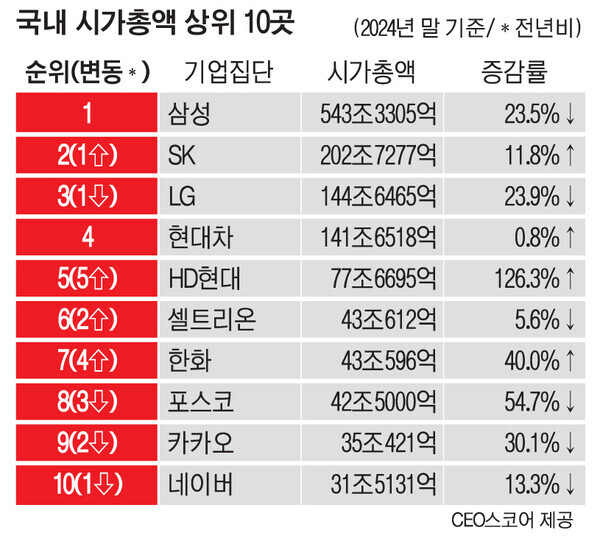

According to a recent survey by CEO Score, a corporate data research firm, the total market capitalization of 79 listed affiliates belonging to 88 designated conglomerates plummeted by 251 trillion won (approximately US$188 billion) in 2024. This represents a 13.2% decrease from the previous year.

Samsung Takes a Hit

Samsung Group, South Korea’s largest conglomerate, bore the brunt of the market decline. Its market capitalization contracted by a staggering 166.7 trillion won (US$124 billion), a 23.5% decrease. Samsung Electronics, the group's flagship company, accounted for a significant portion of this loss, with its market capitalization shrinking by 165.9 trillion won (US$123 billion). While some affiliates like Samsung Life Insurance and Samsung Fire & Marine Insurance saw increases, the overall trend for the group was negative.

HD Hyundai Soars

In contrast to the downward trend, HD Hyundai Group emerged as a standout performer. The group's market capitalization surged by 126.3% to 77.6 trillion won (US$57.8 billion), propelling it from the 10th to the 5th position among the conglomerates. This impressive growth was fueled by a robust shipbuilding industry and increased investments in power infrastructure.

Other Notable Changes

Posco Group: Experienced a 54.7% decline in market capitalization.

LG Group: Saw a 23.9% decrease in market capitalization.

SK Group: Increased its market capitalization by 11.8%, driven largely by SK Hynix.

Hanwha Group: Saw a significant 40% increase, entering the top 10 rankings.

Conclusion

The substantial decline in the market capitalization of South Korea's major conglomerates underscores the challenges faced by the country's corporate giants. While some groups, like HD Hyundai, have managed to navigate the turbulent market and achieve growth, the overall trend reflects the broader economic uncertainties that have impacted the global market.

[Copyright (c) Global Economic Times. All Rights Reserved.]