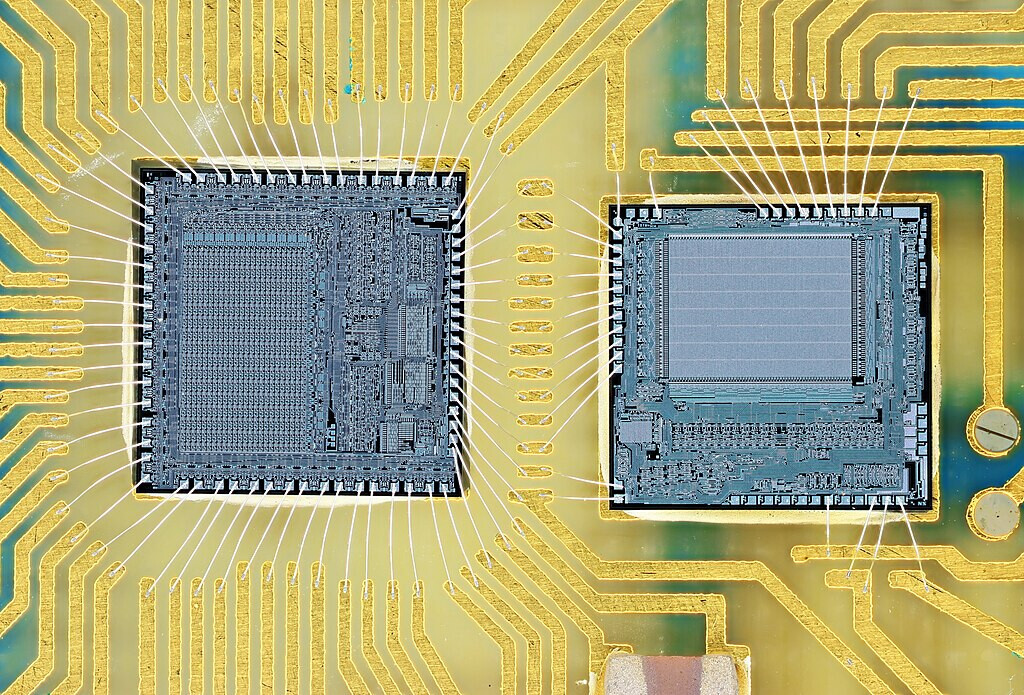

Last January, the news that DeepSeek, a Chinese tech startup, had developed an artificial intelligence (AI) system comparable to OpenAI's flagship product for a relatively small sum of $6 million sent significant shockwaves through the financial markets. As doubts about this unusual achievement grew, the possibility that China circumvented US high-tech export restrictions and procured key components through Singapore, its Southeast Asian hub, quickly emerged.

These suspicions soon appeared to materialize. Singaporean authorities recently indicted three individuals, including a Chinese national, in connection with a large-scale fraud case potentially involving Nvidia chips. This case raises complex questions about how computer servers were transported to Malaysia and their final destination.

The Singaporean government stated that Nvidia does not believe its chips were illegally imported through Singapore, but at the same time emphasized that it "expects US companies like Nvidia to strictly comply with US export controls and Singapore's domestic laws."

Of particular note is the Singaporean government's own partial acknowledgement of its unique economic structure. The government stated, "As an international business hub, Singapore is home to a significant number of major US and European companies with substantial operations here." It further explained that "Nvidia has indicated that many of these customers purchase chips through their Singaporean entities for use in products that will be exported primarily to the US and Western countries."

Indeed, Nvidia's financial reports show that Singapore is a major market accounting for 18% of the company's total revenue, but the physical volume of chip shipments is less than 2%. This suggests that a significant number of transactions may be 'paper transactions' that only pass through Singapore on paper.

This case, which is still awaiting a final court decision, clearly illustrates the potential risks faced by Singapore with its open economic structure. Earlier, the Financial Times reported last year that China was suspected of using financial intermediaries such as trading companies, shell companies, and holding companies to establish a 'backdoor' into Western markets and act as nominal buyers of export-controlled items. In particular, the term 'Singapore-washing' is used to criticize the practice of Chinese companies establishing subsidiaries or relocating their legal entities to Singapore to avoid geopolitical risks and regulations.

Singapore's strong corporate secrecy regulations are also cited as a problem. Broad protection for foreign investment can make it difficult to quickly identify the final recipients of goods. Analysts point out that tracking the purchase route can be even more complex in cases like Nvidia's, where the final destination is another country.

The Singaporean government admitted that difficulties still exist in identifying the link between physical goods transactions and financial transactions. There is a potential blind spot between separate monitoring systems for trade flows and bank flows. In response, the Singaporean government has acknowledged these issues and introduced new regulations to enhance transparency, but the register of nominee shareholders remains undisclosed, raising doubts about their effectiveness.

Furthermore, the widespread practice of registering companies in tax havens such as the Cayman Islands and the British Virgin Islands further undermines the transparency of financial flows and makes it more difficult to trace the actual origin of companies. In July 2023, Singaporean authorities uncovered a large-scale money laundering case involving former Chinese nationals who had obtained passports from Cyprus, Cambodia, and other countries. They were found to have laundered large sums of money in Singapore, invested in luxury goods, and invested heavily in fraudulent complex projects in the Philippines.

Overall, these complex issues can be exploited by actors within China to conceal financial flows and potentially circumvent international technology transfer regulations. In the face of rapidly changing circumstances, continuous monitoring and efforts to improve regulations by regulatory authorities are required.

[Copyright (c) Global Economic Times. All Rights Reserved.]