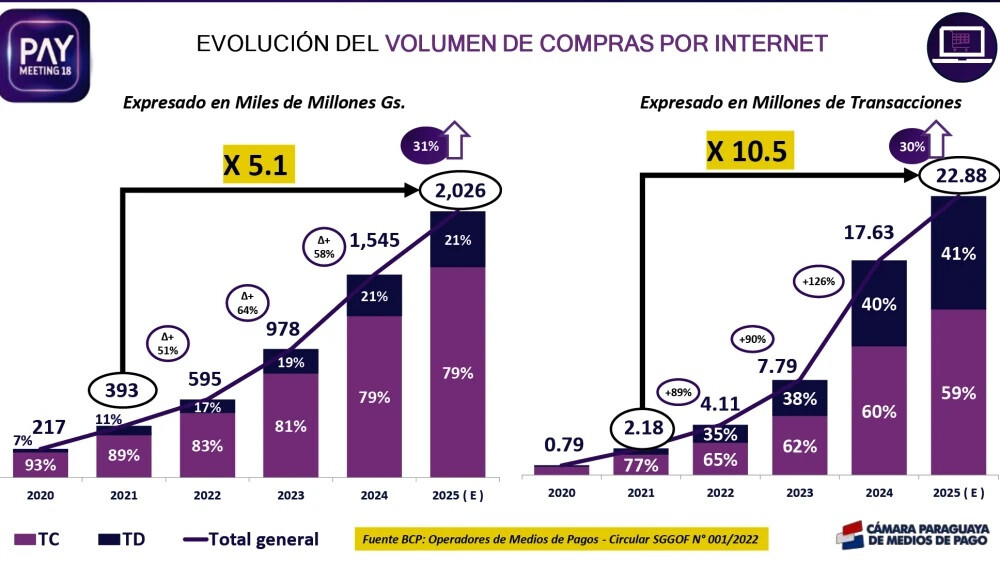

In 2025, Paraguay's online purchases broke a new record, reaching G. 2 trillion. This represents a fivefold increase compared to 2021, showing that e-commerce is no longer an unfamiliar trend but has become a daily consumer habit.

This rapid growth was revealed in the annual payment methods statistical report presented by Rodney Acevedo, CEO of COIN SA, at the 'Pay Meeting 2025' hosted by the Paraguayan Payment Methods Chamber (CPMP). According to the report, 79% of all online transactions were made with credit cards and 21% with debit cards. Notably, debit card payments showed a steep rise in both transaction volume and number of transactions.

Consumer Trend: Digitalization of Small-Value Payments

The most remarkable point of this report is that consumers are no longer using digital payments only for high-value purchases. Acevedo explained, “In the past, people would only use a card for a large purchase at the supermarket, but now they are using QR codes or cards to buy even a single carton of milk. Digital methods are replacing cash for small-value payments.” This shift is analyzed as a result of digital payments being increasingly perceived as a "faster, more practical, and simpler" method.

While debit cards account for only 20% of online payment value, they already make up 40% of the number of transactions. This signifies that consumers are placing increasingly greater trust in online platforms and various digital payment methods.

Number of Transactions Surpasses Cash Withdrawals

Acevedo emphasized that the number of debit card transactions increased by fivefold and the number of active cards grew by 2.2 times. This is clear evidence that more people are making small-value digital transactions on a daily basis. This phenomenon suggests that beyond a change in payment methods, consumer habits themselves are fundamentally shifting. As purchases are being made in new channels and in different ways, e-commerce is opening up new opportunities for both businesses and consumers.

In a landmark achievement for the first time in Paraguay's financial system, the total number of transactions surpassed the number of cash withdrawals in 2025. In the overall payment market, including online payments, debit cards accounted for 81% and credit cards for 19%.

In 2025, a total of 413 million transactions occurred, a fivefold increase from 2021, which amounts to approximately 13.3 transactions per second. This remarkable growth clearly demonstrates the acceleration of Paraguay's digital transformation.

[Copyright (c) Global Economic Times. All Rights Reserved.]