(C) The Star

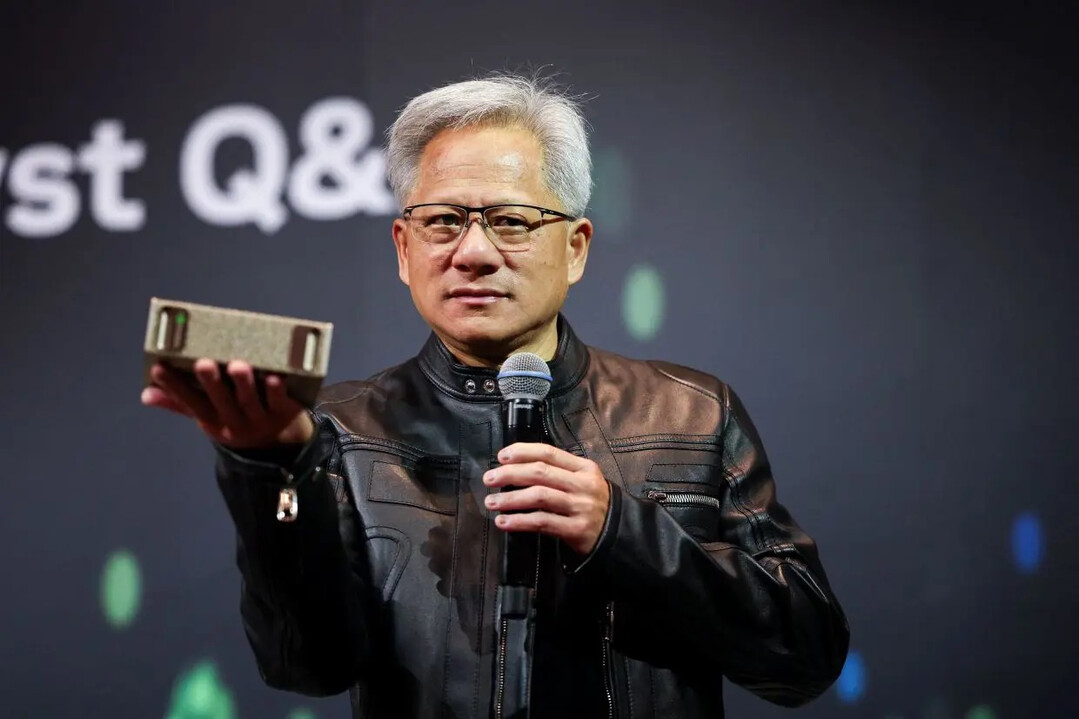

HSINCHU, Taiwan — Jensen Huang, CEO of artificial intelligence (AI) chip powerhouse Nvidia, announced on November 8th (local time) that the company has received samples of the most advanced memory chips from key global suppliers: Samsung Electronics, SK Hynix, and U.S.-based Micron Technology. This cutting-edge memory is widely understood to be the next-generation High Bandwidth Memory (HBM) HBM4, which is currently being developed and positioned for future supply to Nvidia's accelerator platforms.

Huang’s disclosure came while speaking with reporters at the annual sports day event hosted by his company's long-time manufacturing partner, Taiwan Semiconductor Manufacturing Co. (TSMC), in Hsinchu. He was emphatic about the crucial support from his memory partners. "SK Hynix, Samsung, and Micron are all incredibly good memory makers, and they have scaled up tremendous capacity to support us," Huang stated. This scaling is directly aimed at accommodating the soaring demand for Nvidia's AI chips, particularly the latest Blackwell architecture-based GPUs.

Surging Demand Spurs TSMC Wafer Request

The Nvidia CEO’s comments underscore the intense and unabating global demand for AI infrastructure. To keep pace, Huang confirmed he had also formally requested TSMC to increase its supply of wafers—the thin, circular silicon substrates essential for manufacturing semiconductor chips.

"The business is very strong, and it is growing and getting stronger every month," Huang asserted, indicating that the AI boom continues to drive exponential growth for Nvidia across its entire product ecosystem, which now includes not only GPUs but also CPUs, networking equipment, and switches. This expansion means a corresponding surge in demand for the silicon substrates sourced from TSMC.

TSMC CEO C.C. Wei confirmed Huang's request for additional wafers but maintained that the specific volume remained confidential. Wei took the opportunity to assure employees that TSMC is poised to set new revenue records every year, a testament to the foundry's critical role in the AI supply chain. Huang, in turn, praised the foundry’s capabilities, noting, "TSMC is doing a very good job supporting us on wafers."

Addressing Supply and Price Dynamics

When questioned about potential memory supply shortages—a recurring concern in the rapidly expanding AI market—Huang acknowledged that while the business is experiencing strong growth, "shortages could appear in various sectors." However, he stressed the memory manufacturers' efforts in production expansion to mitigate widespread issues.

Regarding the possibility of future memory price hikes, Huang deflected the question, stating, "It’s for them to decide how to run their business." This response leaves the door open for potential price adjustments as memory makers navigate the costs associated with scaling up capacity and perfecting the complex manufacturing of advanced chips like HBM4.

The collective efforts by Samsung, SK Hynix, and Micron to supply advanced HBM samples demonstrate the fierce competition and strategic importance of the memory market in the age of AI. Nvidia’s success, symbolized by its historic market valuation, remains inextricably linked to the production capabilities and technological advancements of its core partners, TSMC for manufacturing and the South Korean and U.S. giants for next-generation memory.

[Copyright (c) Global Economic Times. All Rights Reserved.]