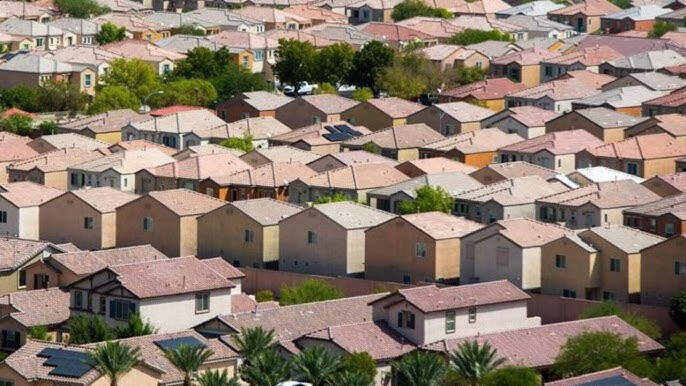

Las Vegas, Nevada – As housing prices in Nevada continue their upward trajectory, state lawmakers are exploring measures to limit the number of homes corporations can purchase.

State Senator Dina Neal, representing parts of Clark County, is the sponsor of Senate Bill 391. Senator Neal stated that the bill aims to foster a fairer competitive environment in the home buying market.

"We have families out there who are truly living the American Dream, working as pharmacists, teachers, and wanting to get a mortgage with their hard-earned income to buy a home. But in the current market, that's becoming impossible," Neal explained.

The proposed legislation includes provisions to cap the number of residential properties corporate investors can acquire annually and establish a statewide registry system to track corporate investor activity.

Dr. Nicholas Irwin, Research Director at the Lied Center for Real Estate Studies at UNLV, believes the bill could have positive effects. "This bill would allow us to accurately understand how many properties investors own. For instance, if a company called ABC Investments buys 1,000 homes, they might register each property under a different Limited Liability Company (LLC), making it difficult to identify the true owner through assessment records alone," Dr. Irwin elaborated.

The Lied Center estimates that approximately 20% of home purchases in Clark County over the past few years have been made by corporate buyers.

Supporters of the bill argue that competition from corporate investors has made it nearly impossible for average homebuyers to compete. Miriam Baison, a Las Vegas real estate agent and non-profit representative, pointed out, "Even if someone is pre-approved for a mortgage, they are often at a disadvantage because many corporations are securing properties with all-cash offers."

Conversely, opponents of the bill express concerns that it could disrupt the housing market. Azim Jessa of the Nevada Realtors Association argued, "Some companies in Nevada buy over 100 homes a year and employ hundreds of people. If this bill passes, those companies might not be viable anymore, and ultimately, banks will end up selling foreclosed homes in bulk to corporations without the real estate transfer tax."

A key difference between this bill and a similar one proposed in 2023 is the significant reduction in the cap on corporate home purchases, from 1,000 to 100 properties annually.

Corporate Home Buying Trends: Nationwide, the proportion of single-family homes purchased by corporations has been steadily increasing. In some areas, this figure exceeds 30%, and it is often cited as a major contributing factor to rising home prices and intensified buying competition.

Economic Impact Analysis: Analyses suggest that the bill's implementation could lead to a short-term decrease in market liquidity and a slowdown in construction due to reduced corporate investment. However, there are also positive long-term projections indicating a potential stabilization of housing prices as the market shifts towards owner-occupiers.

Similar Cases in Other States: California and other states have seen discussions or implementations of legislation aimed at limiting or regulating corporate home purchases. These cases could serve as important reference points for the Nevada State Legislature's deliberations.

Community Reactions: Within Nevada, particularly in Las Vegas and surrounding areas, there are divided opinions on the proposed bill. Prospective homebuyers generally support the legislation, while the real estate industry and some investors have voiced concerns about market contraction.

Bill Passage Outlook: Senate Bill 391 has been referred to the relevant committee and is awaiting review. The ultimate passage of the bill will depend on the outcome of the committee's deliberations and the subsequent votes in the full Senate and Assembly.

The Nevada State Legislature's decision on this significant issue of limiting corporate home buying will be closely watched.

[Copyright (c) Global Economic Times. All Rights Reserved.]