SEOUL — South Korea’s export economy is witnessing a stark "K-shaped" divergence. While the nation’s total export volume has breached historic milestones, the wealth is increasingly concentrated at the very top. New data reveals that a mere 10 companies now dictate nearly 40% of the country’s entire outbound trade, prompting the government to roll out an aggressive financial package to bridge the widening gap between industrial titans and regional SMEs.

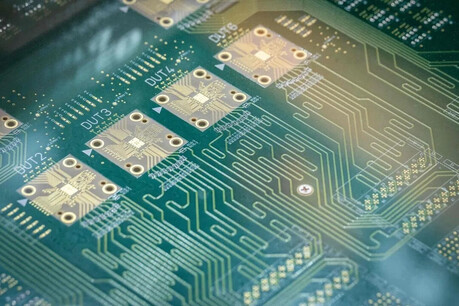

The Semiconductor Surge and the 40% Threshold

According to the National Data Agency (NDA) on February 10, South Korea's annual exports for last year reached an all-time high of $709.4 billion, a 3.8% increase from the previous year. However, this celebration is tempered by a growing structural imbalance.

The Top 10 exporters—led by industry leaders like Samsung Electronics, SK Hynix, and Hyundai Motor—accounted for 39.9% of the total export value. The concentration became even more pronounced in the fourth quarter of last year, where the Top 10’s share spiked to 43.4%, a 5.3 percentage point jump compared to the same period in 2025.

"The deepening concentration is primarily a byproduct of the semiconductor boom," explained Jung Kyu-seung, head of the Corporate Statistics Team at the NDA. The global appetite for High Bandwidth Memory (HBM) and AI-related hardware has funneled massive revenues into a handful of tech conglomerates, leaving the remaining 70,000 export-oriented firms to compete for a shrinking slice of the pie.

The Government’s "Productive Finance" Strategy

In response to this "K-style polarization," Deputy Prime Minister and Minister of Economy and Finance, Koo Yun-cheol, chaired the Ministerial Meeting on External Economy on Tuesday. The government unveiled a comprehensive roadmap to decentralize economic power through the Export-Import Bank of Korea (KEXIM).

The strategy involves a massive capital injection into future growth engines:

AI & Tech: $22 trillion won (approx. $16.5 billion) over five years for the AI industry.

Strategic Industries: 50 trillion won for semiconductors, bio-tech, and battery sectors.

Global Infrastructure: 100 trillion won to support "mega-projects" in nuclear power, defense, and infrastructure.

Trade Stability: 150 trillion won to help firms navigate a worsening global protectionist environment.

A pivotal shift in this policy is the 35% regional mandate. KEXIM will now be required to direct at least 35% of its total credit to companies located outside the Seoul metropolitan area.

Revitalizing the Provinces: The 270 Trillion Won Bet

To prevent the hollowing out of regional economies, the government is launching "Mega-Special Zones" and fostering ten dedicated "Tech Startup Cities" across the provinces. To back this up, a 2 trillion won "Fund of Funds" and a 150 trillion won "National Growth Fund" (with 40% earmarked for regional projects) are being established.

Furthermore, the government is leveraging big business to save the small. By relaxing "separation of finance and industrial capital" regulations—specifically for companies investing in regional subsidiaries—the government aims to facilitate 270 trillion won in regional investment from the top 10 business groups over the next five years.

Analysis: A Structural Fortress Hard to Breach

Despite these ambitious financial "carrots," experts remain skeptical about a quick fix. The concentration of talent and capital in Seoul remains a formidable barrier.

"It’s not just about the money," noted an Investment Banking (IB) industry insider. "Top-tier talent avoids the provinces, and even second-generation owners of regional SMEs are increasingly reluctant to inherit family businesses. Beyond subsidies, we need to facilitate aggressive Mergers and Acquisitions (M&A) to keep these regional firms viable."

Eyes on Washington

The government is also moving proactively regarding trade relations with the U.S. Deputy Prime Minister Koo signaled that Korea would not wait for the formal enactment of the "Invest in America Special Act" to begin vetting projects. "We will establish a preliminary review system for candidate projects identified by both nations to ensure our exporters remain competitive regardless of shifting trade winds," Koo stated.

As South Korea enters this new era of $700 billion exports, the challenge is no longer just about "how much" it sells to the world, but "who" gets to participate in that success.

[Copyright (c) Global Economic Times. All Rights Reserved.]