(C) The Straits Times

SEOUL – South Korea’s national tax revenue saw a significant rebound last year, driven by a "super-cycle" in the semiconductor sector and a retail investing frenzy in global equity markets. According to data released by the Ministry of Economy and Finance (MOEF) on Tuesday, total national tax revenue for 2025 reached 373.9 trillion won, marking an increase of 37.4 trillion won compared to the previous year.

The figures marginally surpassed the government’s supplementary budget target of 372.1 trillion won by 1.8 trillion won. This represents a turning point for the nation’s finances, which have been plagued by massive revenue shortfalls over the past two years.

The Engine of Growth: Chips and Stocks

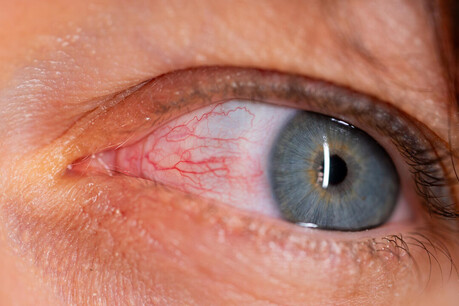

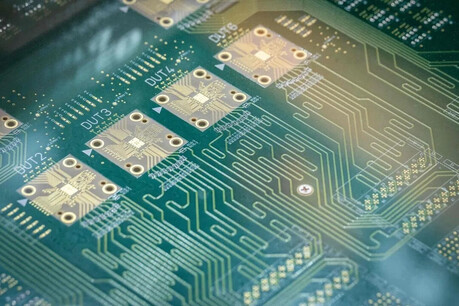

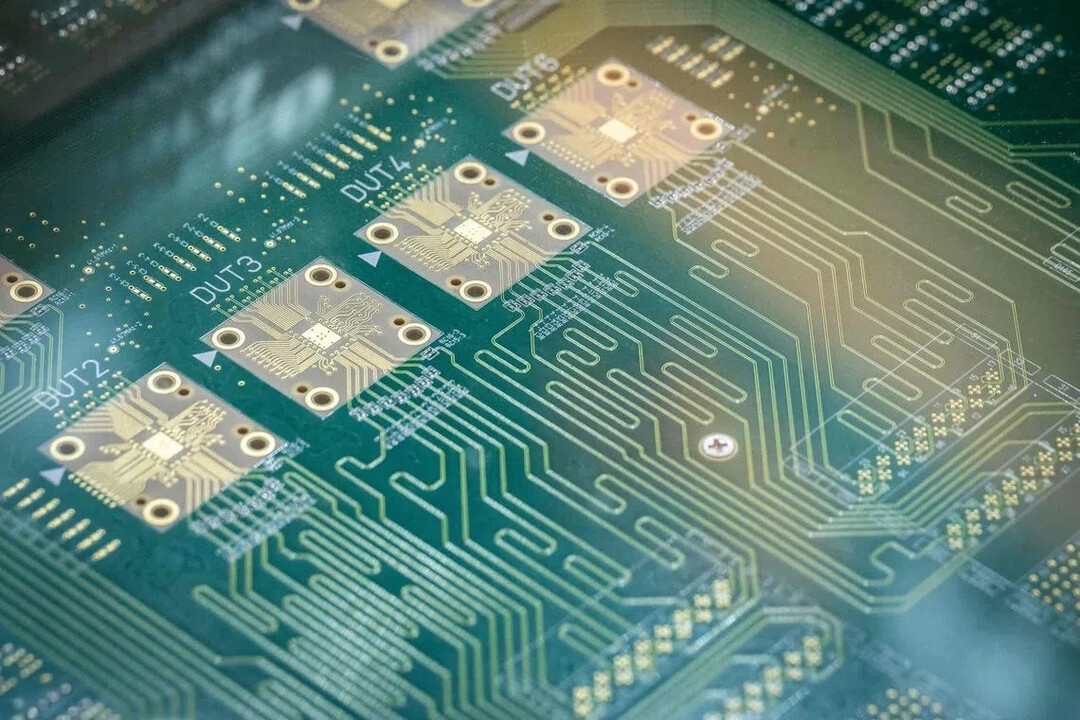

The primary driver behind this fiscal windfall was the Corporate Tax, which surged by 22.1 trillion won. This growth is largely attributed to the stellar performance of South Korea’s tech giants, which benefited from high demand for high-bandwidth memory (HBM) and AI-related hardware.

Beyond the industrial sector, the "ants"—a local term for retail investors—played a crucial role. As both domestic and overseas stock markets thrived:

Capital Gains Tax rose by 3.2 trillion won due to successful overseas "Seohak" trading.

Special Tax for Rural Development increased by 2.2 trillion won, fueled by high trading volumes on the KOSPI.

Income Tax also saw a boost of 7.4 trillion won, supported by steady wage growth across major industries.

The Challenges: VAT Refunds and Policy Changes

Despite the overall growth, some sectors saw declines. Value-Added Tax (VAT) revenue dropped by 3.1 trillion won, ironically due to the export boom; as exports increased, the government had to issue higher VAT refunds to companies. Furthermore, the Securities Transaction Tax decreased by 1.3 trillion won following a planned reduction in tax rates aimed at boosting market liquidity.

A "Soft Landing" for the Revenue Gap

While the results are positive compared to the supplementary budget, the 373.9 trillion won figure is still 8.5 trillion won short of the original 2025 budget (382.4 trillion won). This marks the third consecutive year of "tax holes," where actual revenue fails to meet initial projections.

However, the scale of the deficit has shrunk dramatically:

2023: 56.4 trillion won shortfall

2024: 30.8 trillion won shortfall

2025: 8.5 trillion won shortfall

To prevent a catastrophic fiscal gap, the government proactively adjusted its targets last June. At that time, authorities lowered the revenue goal by approximately 10 trillion won, citing domestic consumption slumps following the martial law incident and global trade uncertainties.

Fiscal Normalization and Future Outlook

"We adjusted the revenue targets early to prevent the side effects of forced budget non-fulfillment or restricting ministry spending in the latter half of the year," a Ministry official explained. "By doing so, we have normalized fiscal operations and minimized the margin of error."

The final settlement for the 2025 fiscal year showed a Total Revenue (including non-tax income) of 597.9 trillion won, slightly under the 600 trillion won target. On the expenditure side, the government executed 591 trillion won out of a total available budget of 604.7 trillion won.

As Korea enters 2026, the focus shifts to whether the semiconductor momentum can withstand rising global protectionism and if domestic consumption can recover to match the strength of the export sector.

[Copyright (c) Global Economic Times. All Rights Reserved.]